Articles

Published 2018-07-01

Keywords

- local public goods,

- efficiency,

- externalities,

- federalism,

- elections and campaign contributions

How to Cite

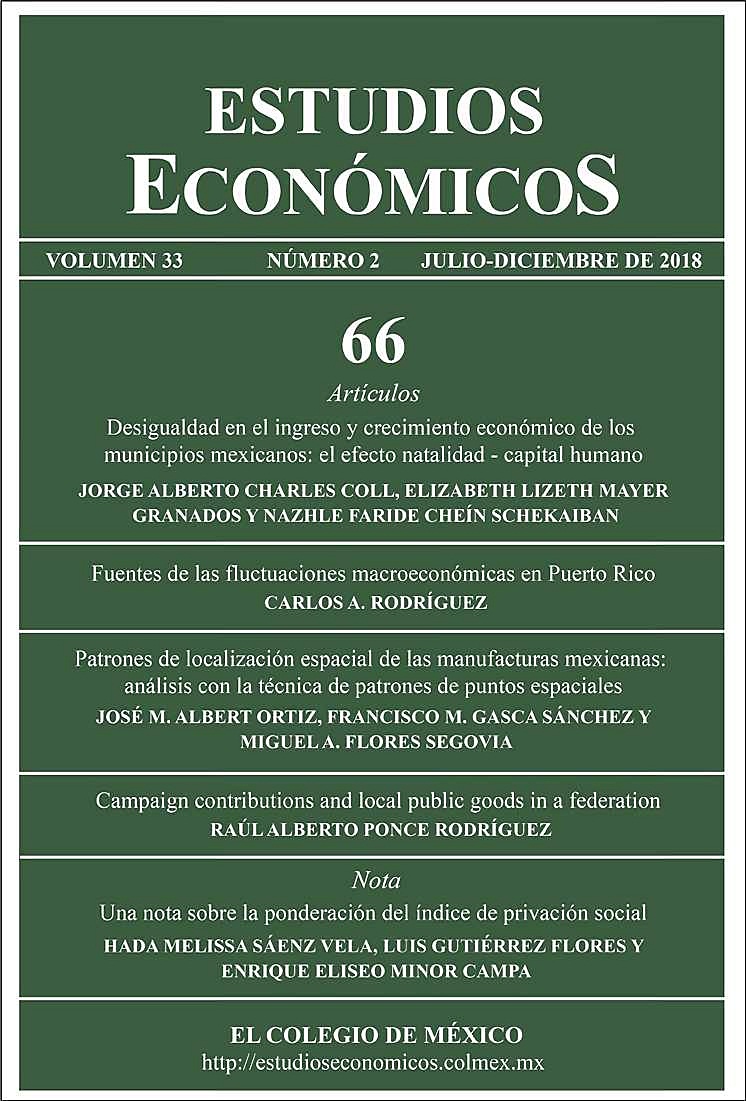

Ponce Rodríguez, R. A. (2018). Campaign contributions and local public goods in a federation. Estudios Económicos De El Colegio De México, 33(2), 283–311. https://doi.org/10.24201/ee.v33i2.360

Abstract

I develop a voting model of decentralized provision of local public goods (LPGs) with campaign contributions. I compare an economy with and without campaign contributions: in the former economy, local governments do not provide Pareto efficient LPGs and do not maximize the welfare gains associated with matching LPGs with the inter-regional heterogeneity of preferences of voters. For the economy with campaign contributions, LPGs with and without spillovers are Pareto efficient, and the system of local governments maximizes the gains associated with matching LPGs with the inter-regional heterogeneity of preferences.

Downloads

Download data is not yet available.

References

- Alt, J.E., and R.C. Lowry, 2000. A dynamic model of state budget outcomes under divided partisan government, Journal of Politics, 62: 1035-1069.

- Bernheim, B.D., and M.Whinston. 1986. Common agency, Econometrica, 54(4): 923-942.

- Besley, T., and S. Coate. 2003. Centralized versus decentralized provision of local public goods: A political economy approach, Journal of Public Economics, 87: 2611-2637.

- Bordignon, M., L. Colombo, and U. Galmarini. 2008. Fiscal federalism and lobbying, Journal of Public Economics, 92(12): 2288-2301

- Caplan, B. 2001. Has Leviathan been bound? A theory of imperfectly con-strained government with evidence from the states, Southern Economic Journal, 67(4): 825-847.

- Cardarelli, R., E. Taugourdeau, and J.P. Vidal. 2002. A repeated interactions model of tax competition, Journal of Public Economic Theory, 4(1): 19-38.

- Chernick, H. 2005. On the determinants of subnational tax progressivity in the U.S., National Tax Journal, 58(1): 93-112.

- Dixit, A., G.M. Grossman, and E. Helpman. 1997. Common agency and coordination: General theory and application to government policy making, Journal of Political Economy, 105(4): 752-769.

- Garman, C., S. Haggarg, and E. Willis. 2001. Fiscal decentralization: A political theory with Latin American cases, World Politics, 53(2): 205-236.

- Grossman, and E. Helpman. 2001. Special interest politics, Cambridge, MITPress.

- Guriev, S., E. Yakoviev, and E. Zhuravskaya. 2010. Interest group politics in a federation, Journal of Public Economics, 94(9-10): 730-748.

- Fletcher, J.M. and M.M. Murray. 2008. What factors influence the structure of the state income tax? Public Finance Review, 36(4): 475-496.

- Hoel, M. and P. Shapiro. 2003. Population mobility and transboundary environ-mental problems, Journal of Public Economics, 87(5-6): 1013-1024.

- Hindriks, J., and G.D. Myles. 2003. Strategic inter-regional transfers, Journal of Public Economic Theory, 5(2): 229-248.

- Hankla, C. 2008. When is fiscal decentralization good for governance? Publius: The Journal of Federalism, 39(4): 632-650.

- Kochi, I, and R.A. Ponce-Rodríguez. 2011. Voting in federal elections for local public goods in a fiscally centralized economy, Estudios Económicos, 26(1): 124-149.

- Lockwood, B. 2002. Distributive politics and the costs of centralization, The Review of Economic Studies, 69: 313-337.

- Lockwood, B. 2008. Voting, lobbying and the decentralization theorem, Economics & Politics, 20(3): 416-431.

- Lockwood, B. 2015. The political economy of decentralization, in: E. Ahmad, and G. Brosio (eds), Handbook of Multilevel Finance, Edward Elgar Publishing, pp.33-60.

- Mansoorian, A., and G.M. Myers. 1993. Attachment to home and efficient purchases of population in a fiscal externality economy, Journal of Public Economics, 52(1): 117-132.

- Myers, G. 1990. Optimality, free mobility, and the regional authority in a federation, Journal of Public Economics, 43(1): 107-121.

- Myerson, R.B. 1993. Incentives to cultivate minorities under alternative electoral systems, American Political Science Review, 87(4): 856-869.

- Oates, W. 1972. Fiscal Federalism, Harcourt Brace, New York.

- Oates, W. 1999. An essay on fiscal federalism, Journal of Economic Perspectives, 37(3): 1120-1149.

- Persson, T., and G. Tabellini. 2002. Do political institutions shape economic policy? Econometrica, 70(3): 883-905.

- Reed, W.R. 2006. Democrats, republicans and taxes: Evidence that political parties matters, Journal of Public Economics, 90(4-5): 725-750.

- Roemer, J.E. 2001. Political competition theory and applications, Cambridge, Massachusetts: Harvard University Press.

- Rogers, D.L. and J.H. Rogers.2000. Political competition and state government size: Do tighter elections produce looser budgets? Public Choice, 105(1-2): 1-25.

- Silva, E.C.D., and A. Caplan. 1997. Transboundary pollution control in federal systems, Journal of Environmental Economics and Management, 34(2): 173-186.

- Wellisch, D. 1994. Interregional spillovers in the presence of perfect and imperfect household mobility, Journal of Public Economics, 55(2): 167-184.

- Wittman, D. A. 1973. Parties as utility maximizers, American Political Science Review, 67: 490-498.

- Wittman, D. A. 1983. Candidate motivation: A synthesis of alternative theories, The American Political Science Review, 77: 142-157.