Articles

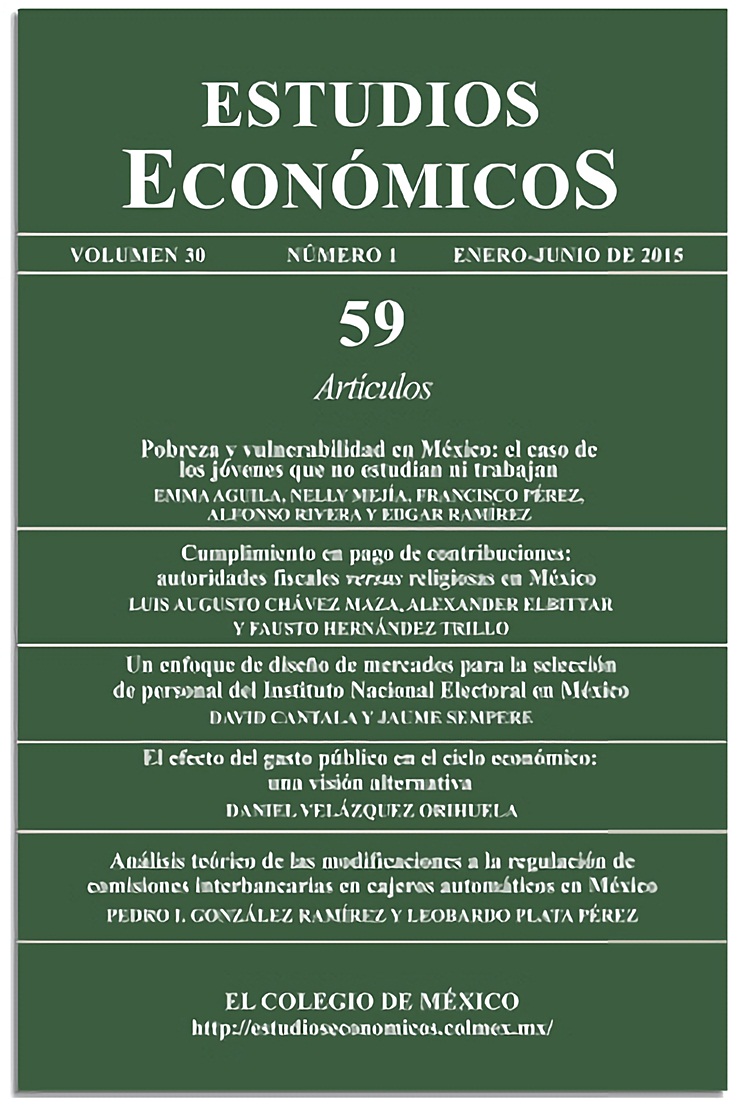

Compliance in contributions payment: Fiscal authorities versus religious authorities in Mexico

Published 2015-01-01

Keywords

- confianza fiscal,

- correspondencia fiscal,

- aportaciones voluntarias,

- experimentos en campo

How to Cite

Chávez Maza, L. A., Elbittar, A., & Hernández Trillo, F. (2015). Compliance in contributions payment: Fiscal authorities versus religious authorities in Mexico. Estudios Económicos De El Colegio De México, 30(1), 51–74. https://doi.org/10.24201/ee.v30i1.22

Abstract

This paper studies fiscal correspondence and fiscal trust. Through an experimental design carried out in Oaxaca, Mexico it explores which authority, the religious or the civil one, is better at collecting contributions to finance common goods. Results suggest that fiscal correspondence is the main factor to explain better collection. That is, when the good is observable, people are more willing to pay the contribution.

Downloads

Download data is not yet available.