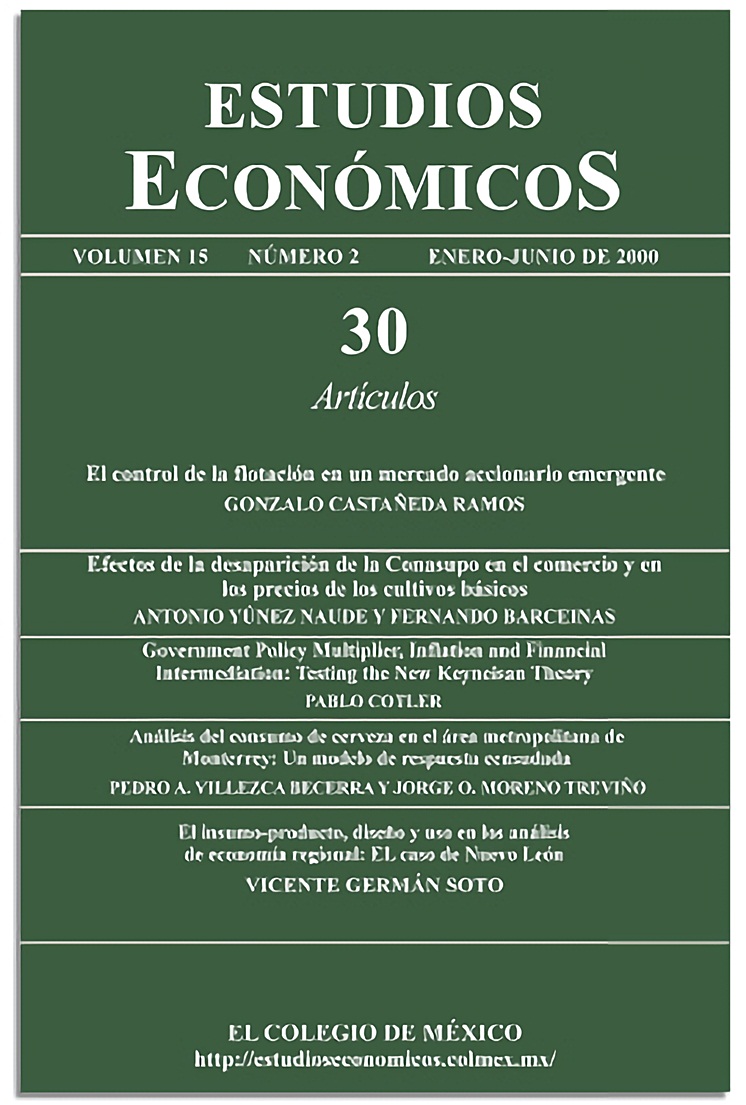

Goverment policy multiplier, inflation and financial intermediation: Testing the New Keynesian theory

Published 2000-07-01

Keywords

- macroeconomics,

- new keynesian theory,

- banking system

How to Cite

Abstract

In a recent issue of the American Economic Review, several authors presented their views regarding what they believe constitute the core of macroeconomics. All of these authors agree that there is a short-run trade-odd between inflation and unemployment. Yet there is a lack of consensus as for why this happens. The purpose of this paper is to test the validity of one of these possible explanations: the new Keynesian theory. For this purpose, we use evidence from 18 countries for the period 1964-1996, on the relation between inflation, output supply elasticity and government-policy multipliers. Empirical evidence seems to support the proposition derived from the new Keynesian school: the value of the fiscal multiplier will be smaller as the average inflation increases and the degree of financial intermediation declines. One consequence of this result is that the effectiveness of government expenditure as a mean to stabilize output depends to a large extent on the soundness of the domestic banking system.